- The Truth About Where Home Prices Are Heading

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story.

- Selling and Buying at the Same Time? Here’s What You Need To Know

If you're a homeowner planning to move, you're probably wondering what the process is going to look like and what you should tackle first.

- Should You Buy a Vacation Home?

Now that summer’s here, you’re probably planning your next getaway. But what if you didn’t have to?

- What You Should Know About Getting a Mortgage Today

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.

- Think No One’s Buying Homes Right Now? Think Again.

If you’ve seen headlines saying home sales are down compared to last year, you might be thinking – is it even a good time to sell?

- Why Big Investors Aren’t a Challenge for Today’s Homebuyer

Remember the chatter in the headlines about all the homes big institutional investors were buying? If you were thinking about buying a home yourself, you may have wondered how you’d ever be able to compete with that.

- Top 5 Reasons To Hire a Real Estate Agent When You Sell

The right agent doesn’t just list your house – they help you sell smarter, faster, and with fewer surprises.

- Multi-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise.

- What Every Homeowner Needs To Know In Today’s Shifting Market

Here’s something you need to know. The housing market is getting back to a healthier, more normal place.

- Think It’s Better To Wait for a Recession Before You Move? Think Again.

Fear of a recession is back in the headlines. And if you’re thinking about buying or selling sometime soon, that may leave you wondering if you should reconsider the timing of your move.

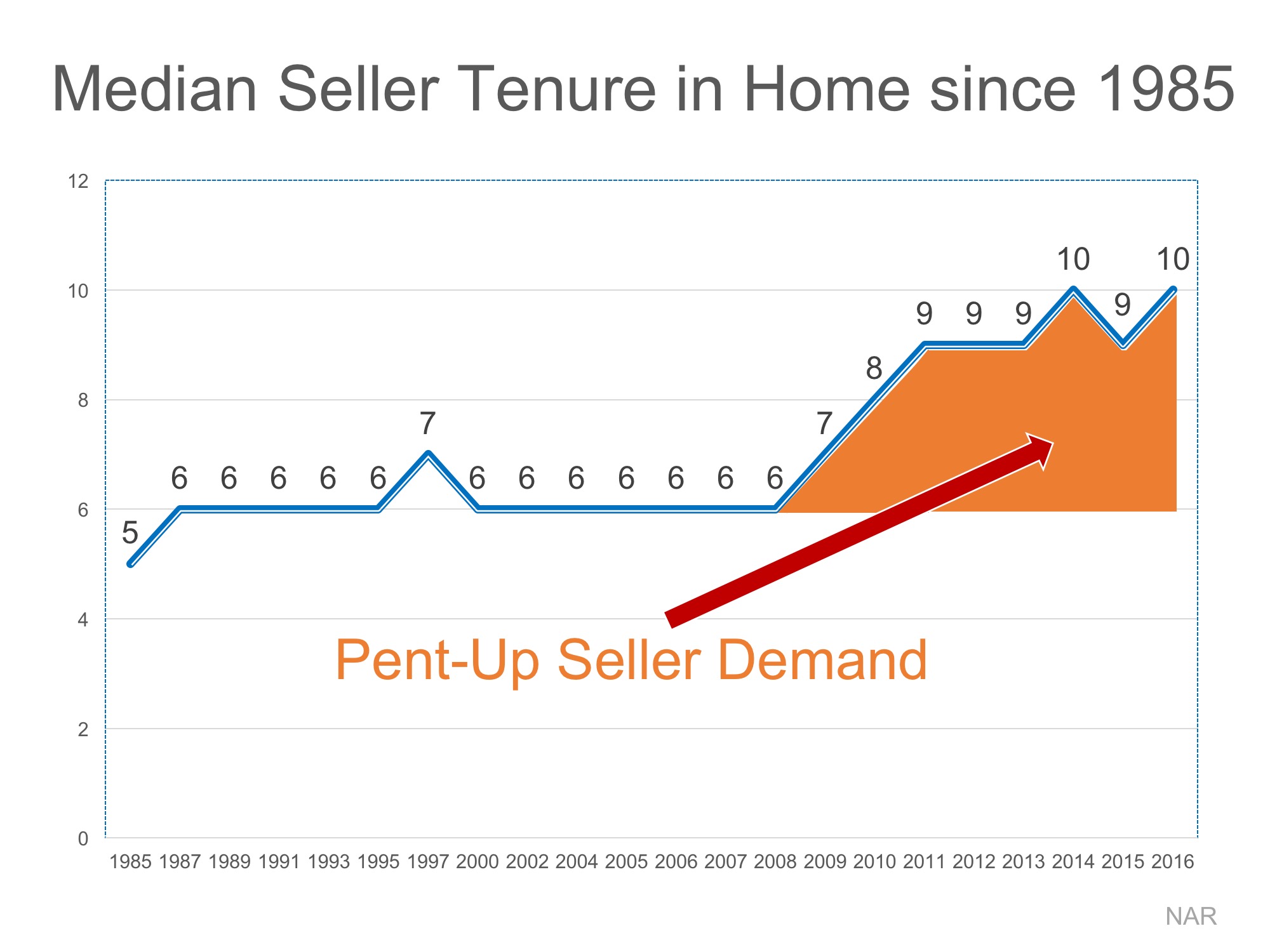

Homeowner’s Net Worth Is Still Greater Than a Renter’s

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).

The latest survey data, covering 2014-2016 will be released later this year. In the meantime, Lawrence Yun, the National Association of Realtors’ Chief Economist estimates that the gap has widened even further, to 45 times greater ($225,000 vs. $5,000)!

Put Your Housing Cost to Work for You

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth. Every time you pay your rent, you are contributing to your landlord’s net worth.

The latest National Housing Pulse Survey from NAR reveals that 84% of consumers believe that purchasing a home is a good financial decision. William E. Brown comments:

“Despite the growing concern over affordable housing, this survey makes it clear that a strong majority still believe in homeownership and aspire to own a home of their own. Building equity, wanting a stable and safe environment, and having the freedom to choose their neighborhood remain the top reasons to own a home.”

Bottom Line

If you are interested in finding out if you could put your housing cost to work for you by purchasing a home, let’s get together and evaluate your ability to buy today!

Powered by WPeMatico

![What State Gives You the Most ‘Bang for Your Buck’? [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/04155449/STM-Share.jpg)

![What State Gives You the Most ‘Bang for Your Buck’? [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/04155326/20170811-100-Gets-You-STM.jpg)

![20 Tips for Preparing Your House for Sale [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/07/17162328/20170804-Share-STM.jpg)

![20 Tips for Preparing Your House for Sale [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/07/17162255/20170804-Tips-For-Selling-STM.jpg)